Elbow Park, Calgary, during the 2013 flood. Photo: Andy van der Raadt/Flickr (Creative Commons)

Insurance companies push cities to take climate action

The cleanup bill is a powerful motivator.

After the Calgary flood of 2013, the Bow and Elbow rivers receded from city streets to reveal billions of dollars worth of damage: $6-billion, to be specific.

About $4 billion of that was uninsured.

As the impacts of climate change are felt, more extreme weather events—including droughts and more frequent floods—will come. And with those changes come mounting risks and costs.

Who will be left shouldering that financial burden?

Insurance companies want to be sure it’s not them. So they’re changing how they operate in light of climate change.

Zurich Insurance Group, for example, revealed last month that they won’t invest in or underwrite companies that generate more than 30% of their revenue from coal or the oilsands. Zurich has committed to all of their business being powered by renewables by 2022.

“As one of the world’s leading insurers we see first-hand the devastation natural disasters inflict on people and communities,” said Zurich CEO Mario Greco in announcing the new policy.

This is part of what Maryam Golnaraghi calls “an all-of-society conversation” about climate change.

Insurance is, after all, an absolute foundation for the protection of society — but it is a business.

Golnaraghi is director of extreme events and climate risks at the Geneva Association, an international insurance and risk-management think tank. On a more immediate level, Golnaraghi says companies are looking at the amount of risk they carry and where it comes from.

And that’s leading them to cities.

“The root causes of where risk gets generated comes down to municipal governments,” Golnaraghi said.

Inaction no longer an option

When it comes to preparing for climate change, we talk in terms of “adaptation” or “resilience.” And Calgary has a plan for that.

The City of Calgary’s climate adaptation action plan was accepted by city council last fall, as a part of their overall climate strategy. It looks at how we reduce our risks and prepare for the coming changes—not if, but when they come.

- S9 | The Climate Action Edition

The climate cost of a sprawling city

Calgary’s 2011 climate plan failed. Will the new one work?

In an interview with The Sprawl earlier this year, Dick Ebersohn, manager of city hall’s climate and environment department said creating such a plan was imperative.

“We are an international city and we understand that we want to improve our current economic state and our future economic state,” said Ebersohn. “And one of the key pieces to do that is to drive a low-carbon economy, as part of the world economy—and of course to protect our environment.”

“Another part of that is really to reduce our risk, because what we’ve seen is severe weather events are in the top five [most] serious risks that are being posed to Calgary,” he said.

And that’s where insurance comes in.

“Insurance companies are saying ‘you better make a plan,’” Ebersohn said. “Certain major insurance companies are saying, ‘We will not insure you if you don’t have plans in place.’”

Since 2013, some progress has already been made, at least on the flood front.

Insurance companies are saying, ‘You better make a plan.’

The amount of annual financial risk of damages has decreased by 30%, according to the city. Instead of an average damage risk of $170 million each year from flooding, as Calgary had around 2013, it has now been reduced to about $120 million per year, according to Frank Frigo, the leader of watershed analysis with water resources for the City of Calgary.

“Some of the mitigation measures have greater impact on large amounts [of water], some have greater impact on smaller amounts, some address surface water, some address ground water, some address sewer backup,” said Frigo. “That all combines to give a 30% reduction”

But climate change is exerting force in the opposite direction.

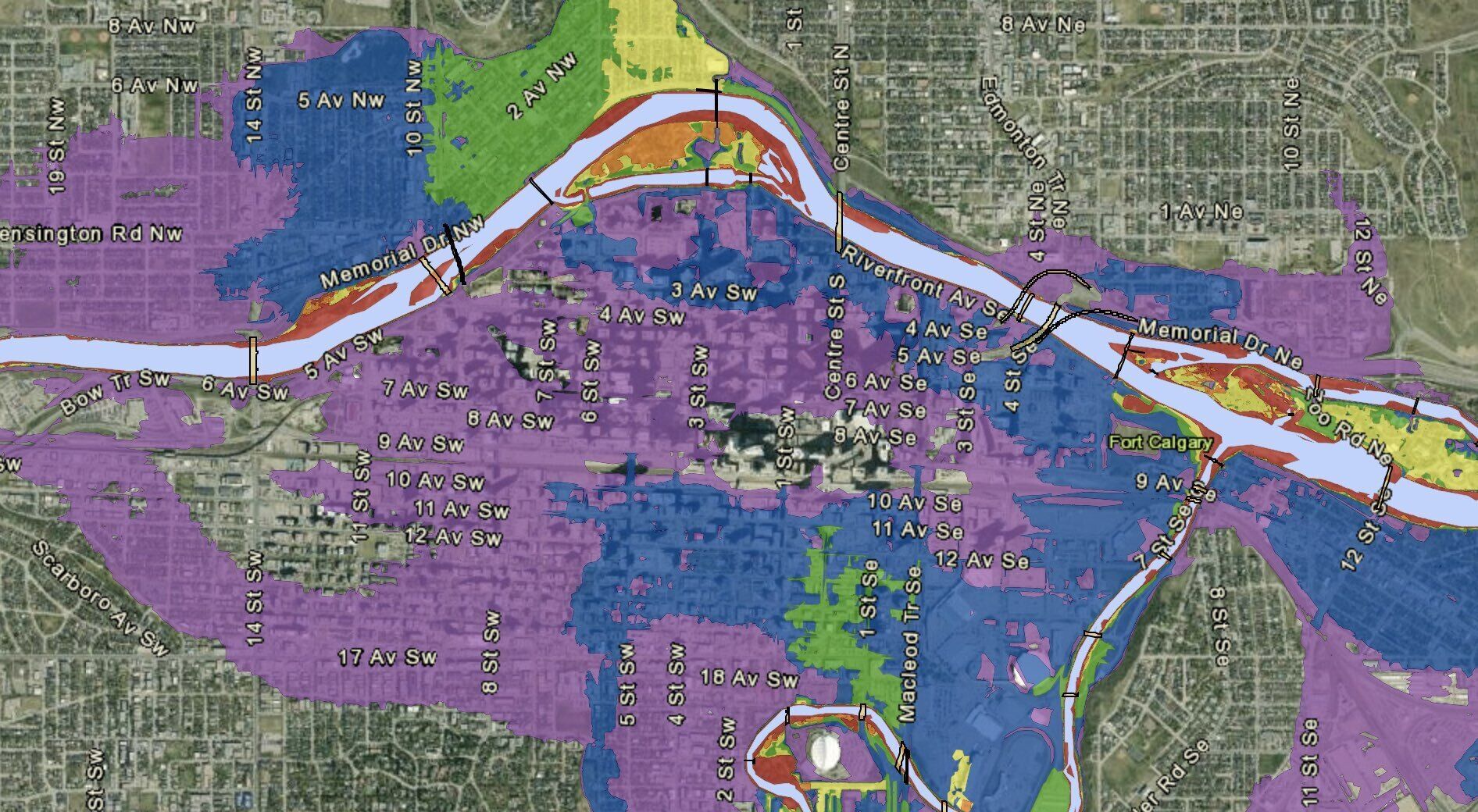

Data collected by the city indicates that winter and spring precipitation is expected to increase by about 18% by 2050. This means a flood that use to be pegged to a 1 in 350 chance of occurring in any given year (or the 350-year flood) will drop to a 1 in 200 chance, Frigo explains.

The 2013 flood was a 100-year flood, so its risk profile will increase to become a 75-year flood.

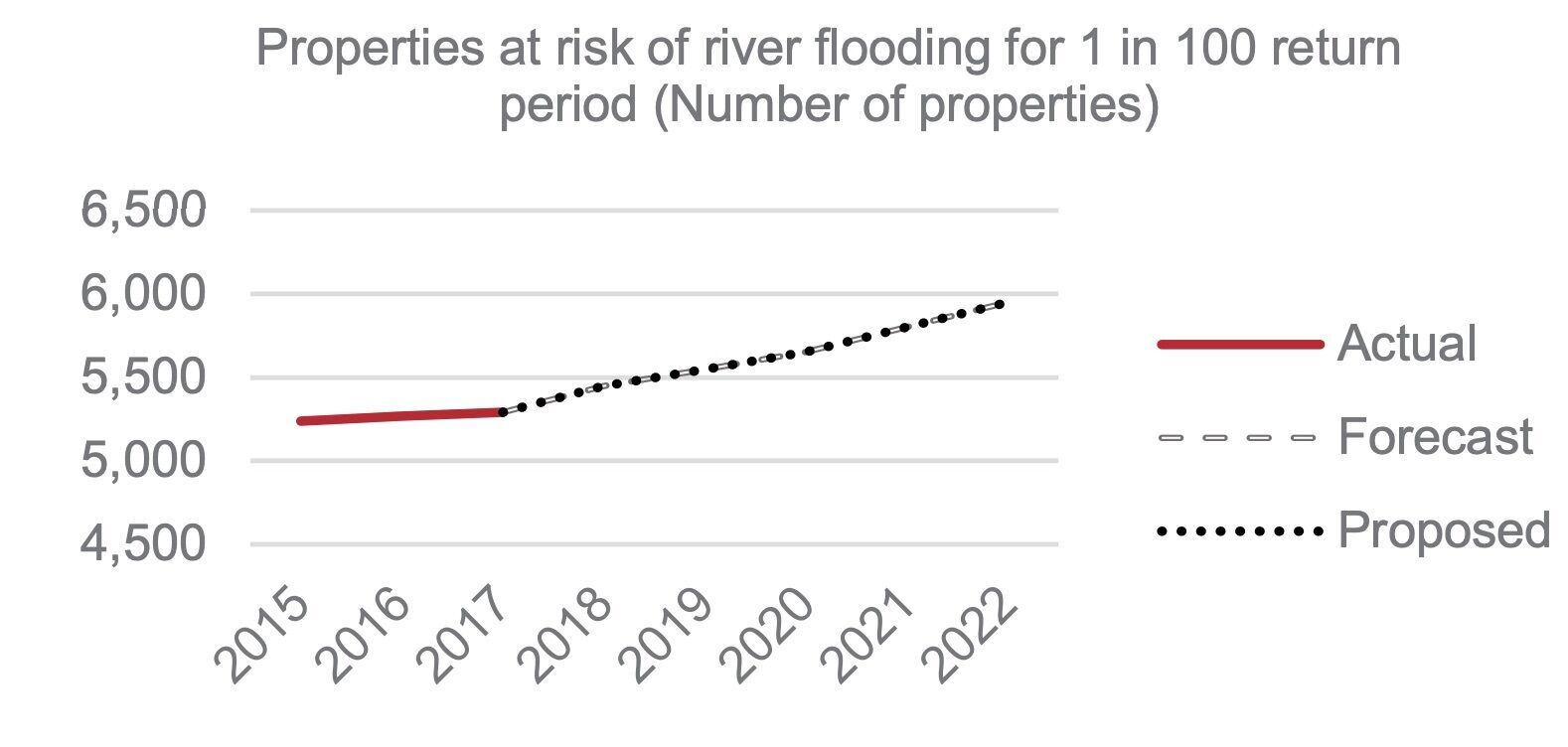

The most recent statistics estimate 5,450 properties are still located in the current 100-year river flood zone. Additionally, 3,371 properties are at the same risk level but for localized or stormwater-related flooding.

And the city’s last budget shows the number of properties at risk is set to grow.

Wind, rain and hail

Calgary has a high risk of destructive storms, too.

The year 2016 was the costliest year of insured damages in Canadian history, primarily due to the Fort McMurray wildfire. However, Calgary is on the costliest events list four times in 2016, just for regular summer storms bringing wind, rain and hail.

Insured storm damages in Calgary that summer alone totalled about $50 million.

According to the Insurance Bureau of Canada, 30 years ago the average cost they fronted for extreme weather was about $400 million a year. Over the last 10 years it’s “skyrocketed to $1 billion or more every year but one.”

With mounting payouts, insurance companies are watching these escalating risk profiles like hawks.

“Insurance is, after all, an absolute foundation for the protection of society—but it is a business,” said Golnaraghi.

There is an interesting dichotomy at play here. Insurance companies want cities to spend money up front to reduce risk. Meanwhile, municipalities make economic decisions based on risk-benefit profiles that rely on insurance companies bearing risk.

Property values also play a role. Homes by the water tend to be more expensive. Pricey properties yield more property taxes for the city. So municipalities stand to benefit from continued development near waterways.

Golnaraghi explains that climate change has pushed the insurance industry in Canada to start working much more closely with governments at all levels. At the municipal level, it means a focus on how zoning is handled in high-risk zones.

“When something gets flooded year after year after year, how can you expect an insurance business to be there for them?” Golnaraghi said.

“The reason you and I can live sustainably is because we have insurance. Are you interested to get insurance from a company that could become insolvent because it’s underwriting a lot of bad risk that someone else has to take responsibility for? No.”

Golnaraghi says in most cases those relationships are amicable and governments and the insurance industry are able to work together to reduce risk on both sides. However, she says that approach has its limits as insurance companies cannot take on indefinitely mounting risk, even if the rates are raised.

Which is where we circle back to the City of Calgary and Ebersohn’s acknowledgement that climate inaction isn’t much of an option anymore. In the worst case scenarios, Golnaraghi says she wouldn’t be surprised to hear that insurance companies would threaten to pull coverage if action wasn’t on the horizon.

“This is the last option,” Golnaraghi said, though she was unfamiliar with Calgary’s specific circumstances.

A more conservative approach

Golnaraghi said halting development in high risk areas is key.

Sasha Tsenkova, a professor in the School of Architecture, Planning and Landscape at the University of Calgary, tends to agree, noting that Calgary isn’t on that page just yet.

“Where we are beginning to talk about climate change, it’s really [in the context of] the future, and the future is very much now,” said Tsenkova. “What we build now is going to be there for the next 20, 30, 50 years.”

Tsenkova says the biggest challenge will be about retrofitting buildings we have built already—the some 5,540 buildings sitting in the 100-year flood zone right now, for example—but adds that new builds need to be more conservatively thought out.

“Maybe those crude measures about risk assessment and what’s an appropriate piece of land for development really need to change and become much more conservative,” Tsenkova said.

“A lot of that is definitely going to trickle down and affect the behaviour of homeowners and individuals, but also developers.”

It’s not just about water or flood protection, it’s also about energy and air pollution and the greenhouse effect.

Calgary updated its flood mapping in 2015 after the flood changed the dynamics of the river. To Golnaraghi, having recent information available to the public and decision makers is important.

She adds that the weight of risk mitigation need not lie with the City alone. The city could incentivize homeowners and businesses to take on retrofits and upgrades.

“We’re not performing extremely well,” Tsenkova said. “There is a lot more that can be done. And in the implementation of resilience, it’s very important to recognize the fact that it’s not just about water or flood protection, it’s also about energy and air pollution and the greenhouse effect.”

Because if emissions aren’t mitigated, the impacts will only get worse.

“It doesn’t stop,” said Tsenkova.

Sarah Lawrynuik is a Calgary-based freelance journalist focusing on politics and energy/climate policy.

The Sprawl is crowdfunded, ad-free and made in Calgary. Become a Sprawl member today to support independent local journalism (now in Canadian currency!).

Support in-depth Calgary journalism.

Sign Me Up!We connect Calgarians with their city through in-depth, curiosity-driven journalism—but can't do this alone! We rely on our readers and listeners to fund our work. Join us by becoming a Sprawl member today!